stamp duty calculation malaysia 2019

The Government of India ISO. Content Writer 247 Our private AI.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Cases are listed in order of their neutral citation and where possible a link to the official text of the decision in PDF format has been provided.

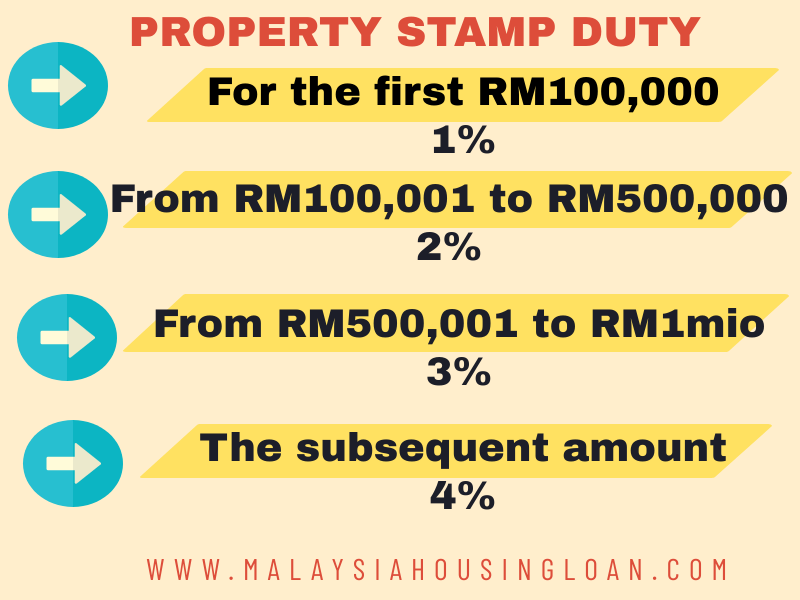

. An import duty rate is linked to every commodity code and is based on TARIC level. 1 per annum on the arrears of outstanding for each loan daily rest basis Early Settlement. The tiers are as follows with effect from 2019.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. Get the latest international news and world events from Asia Europe the Middle East and more. Calculation of Stamp Duty on SPA Memorandum of Transfer and Instrument on Loan Agreement.

Zheng He simplified Chinese. This is a list of judgments given by the Supreme Court of the United Kingdom between the courts inception on 1 October 2009 and the most recent judgments. According to the capital gains tax property 6-year rule she can move interstate again and access another absence period up to six years.

Stamp duty Fee 1. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State. Currently first-time buyers are exempt from paying stamp duty along with anybody purchasing a property below 500000 in England.

No chargesfees provided 3 months prior written notice is given to the bank or payment of 3 months interest on the amount redeemed in lieu of notice. 3 from RM500001 to RM1000000. RM100001 To RM300000 RM400000 Total stamp duty must pay is RM500000 So this is the total stamp duty then you can add legal fees disbursement fees valuation fees and other fees to estimate how much the cost of buying the house.

Form 14A Transfer of Ownership is signed by the purchaser. A contractor who intends to re-export plants and equipment after expiration of a contract may import the plant and equipment into Egypt free of customs duties if certain. Origin Based on international trade agreements ie.

Checks bills of exchange statements of account certificates books of account deeds of transfer of quotas and in some specific cases identified by the Law invoices. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Engine as all of the big players - But without the insane monthly fees and word limits. ASCII characters only characters found on a standard US keyboard.

Because stamp duty is tiered see below table you will pay a different stamp duty rate on different portions of the property value. In addition if a loan was taken out to finance the purchase of the property the stamp duty payable would be a flat rate of 05 of the total loan amount. 6 to 30 characters long.

2 from RM100001 to RM500000. Excise taxes are levied on gasoline aviation fuel tobacco and liquor. The rate was increased to 375 effective 1 April 2019.

Stamp duty is a standard part of buying a property and should be factored into your deposit. Also known as the Central or Union Government and internally as the Centre is the national administrative authority of the Republic of India a federal democracy located in South Asia consisting of 28 union states and eight union territoriesUnder the Constitution there are three primary branches of. Stamp duty taxes Imposta di Bollo apply on a certain list of deeds or documents provided for by the relevant law provision eg.

From 2019 the tax rate is decreased from 021 to 02 of the tax base. Not long after she managed to get another permanent job in Brisbane this time. For First RM100000 RM100000 Stamp duty Fee 2.

Tool requires no monthly subscription. The majority of property buyers will be required to pay stamp duty if the property price is above the threshold. Unless otherwise noted cases were heard by a panel of 5 judges.

Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. The stamp duty is to be made by the purchaser or buyer and not the seller. The rates imposed vary depending on the document.

The stamp duty for the sale and transfer of a property is calculated based on the purchase price. Bhārat Sarkār often abbreviated as GoI. Agreements to sell shares usually attract stamp duty reserve tax SDRT at 05.

05 of loan amount funded for every approved loan. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The purchaser pays the legal fees stamp duty and disbursements accordingly.

Stamp duties applicable to documents for the transfer of shares real estate and mortgages are set out below. Stamp duty is charged at 05 on instruments effecting sales of shares. Must contain at least 4 different symbols.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. The annual fixed assets tax is levied by the local tax authorities on real property and depreciable fixed assets used for business purposes. Bilateral a preferential import duty rate ie.

Stamp duty taxes. The calculation and the amount of the mining royalty remains unchanged. Acquired pre-22 February 2019.

A customs duty is levied on imported goods based on the custom tariff table. 2015s Autumn Statement announced a 3 additional rate of Stamp Duty Land Tax SDLT on purchases of additional properties such as buy to lets and second homes with effect from the 1st April 2016. In 2019 she decided to move back to her home in Sydney and make it her main residence once more while she freelanced.

Sample personal income tax calculation. Over 500000 Words Free. VAT applies on such imported products as 14 of the customs import duty paid the VAT base will be based upon the invoice value CIF the custom duty and other taxes.

The calculation of the NSSS contributions should take into account the sum of basic salary the allowances and benefits limited to a maximum amount equal to the TCPL figure for that particular month. The amount of stamp duty payable will differ and will be based on the nature of every individual transaction. A full stamp duty exemption is given on.

Barbados imposes a stamp duty on various instruments including written documents. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. 13711433 or 1435 was a Chinese mariner explorer diplomat fleet admiral and court eunuch during Chinas early Ming dynastyHe was originally born as Ma He in a Muslim family and later adopted the surname Zheng conferred by the Yongle Emperor.

The liability to SDRT may be cancelled by paying the stamp duty due on a stock transfer form or other transfer instrument executed in pursuance of the agreement. A lower import duty rate may apply to products imported in the European Union in case the goods meet the applicable criteria in the country benefiting from the. 1 on the first RM100000.

Stamp duty is levied on movable and immovable property and property rights if they were acquired in Hungary unless an international agreement rules otherwise. Mortgage loan basics Basic concepts and legal regulation.

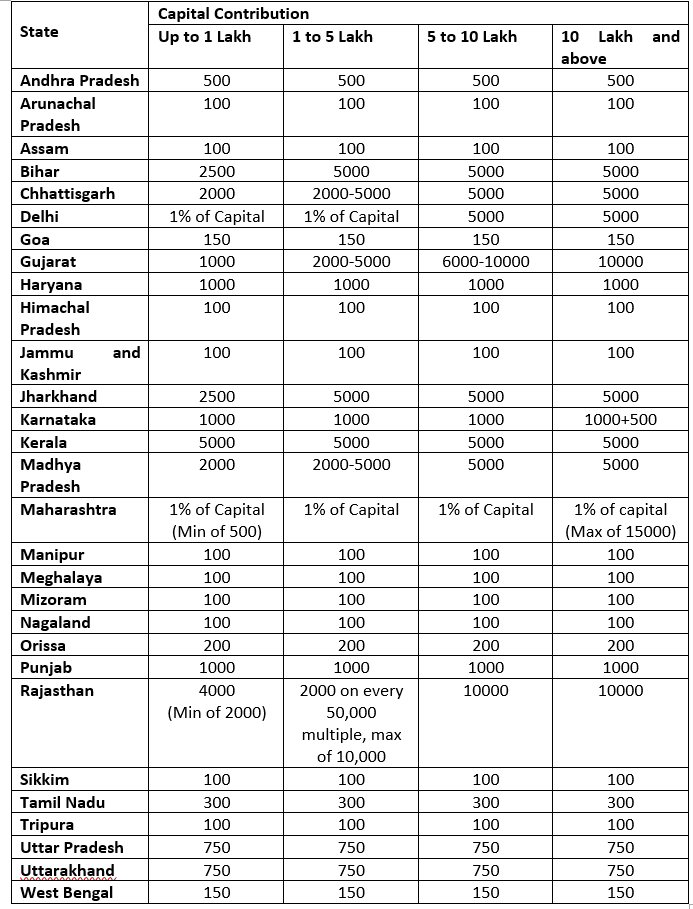

State Wise Rates Of Stamp Duty On Llp Agreement Legalwiz In

All You Need To Know About The Calculation Of Stamp Duty On Different Instruments Ipleaders

Air Travel Taxes The Travel Insider

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2022

Pdf A Review Of Probabilistic Approaches For Available Transfer Capability Calculation Arid Zone Journal Of Engineering Technology And Environment Academia Edu

Spa Stamp Duty Calculator Property Tour Guide

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Calculation Of Stamp Duty On Instruments Of Transfer Of Shares

Memorandum Of Transfer Mot And Stamp Duty In Malaysia Iproperty Com My

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Best Calculator For Property Stamp Duty Legal Fees In Malaysia Free

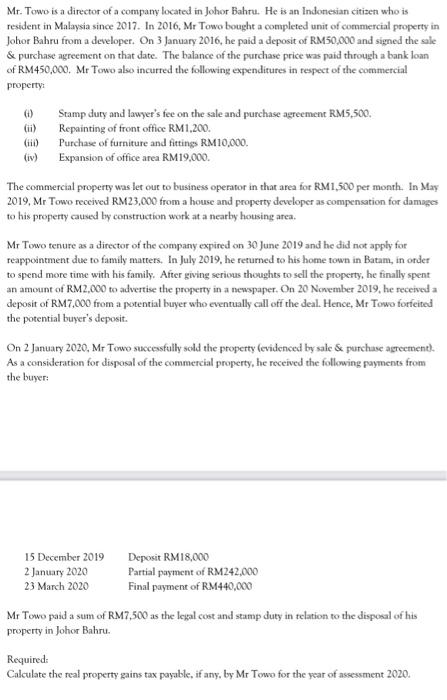

Mr Two Is A Director Of A Company Located In Johor Chegg Com

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia

Malaysia Property Stamp Duty Calculation Youtube

Car Insurance Premium Calculation Ncd Rate In Malaysia

Budget 2019 11 Highlights That Will Affect The Property Market

Ccb Returns With Triple A Rated Jianyuan 2019 2

0 Response to "stamp duty calculation malaysia 2019"

Post a Comment